The CEP Program is a revolutionary turnkey program that combines the benefits of community solar with traditional deregulated energy procurement.

We are proud to partner with 11 Million Acres to offer their CEP program to SBAC members!

-

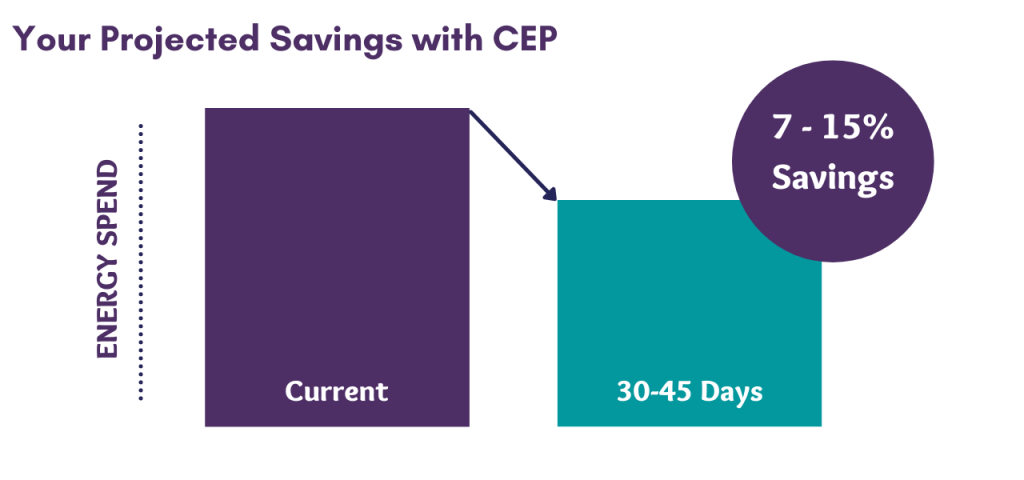

Save up to 20% on your company's electricity bill

-

Raise money for the SBAC

-

Support Renewable Energy Development in Illinois

CEP DELIVERS THE FOLLOWING BENEFITS**

![11MA & SBAC - One Pager[53501] 11MA & SBAC - One Pager[53501]](https://growthzonecmsprodeastus.azureedge.net/sites/1994/2021/06/11MA-SBAC-One-Pager53501-1f8b1b42-c7e1-4d4c-85cd-2f0b79a01b06.jpg)

**Community solar and deregulated energy program requirements and pricing change frequently. 11MA will review each account to determine the optimal CEP Savings strategy for each market. Savings, terms, and conditions may vary by market.