It's no secret that small businesses unite the community. The SBAC’s non-partisan advocacy work has demonstrated the ability to shape local, state and federal legislation for small businesses. We are proud to highlight a few of our successful advocacy efforts and our proven track record of providing non-partisan solutions to help the small business community.

To read more about our current initiatives and how you can join us, click here.

Please translate this page to the language of your choice.

A law has been enacted to support the recovery of Illinois chambers of commerce, many of which were hard-hit by the pandemic but continued to provide vital support to local businesses. With $5 million in funding, it will help chambers recover from revenue losses and continue their essential work. Through a grant program established by the Illinois Department of Commerce and Economic Opportunity, eligible chambers can receive up to one-sixth of their 2019–2020 revenue loss. If any funds remain after these initial grants, additional awards will be given to qualifying chambers. The law applies to chambers with annual revenues up to $1 million, marking a major victory for small businesses. Thank you to the chambers and legislators who championed this initiative, this is a significant win for the small business community! Learn more

A law has been enacted to support the recovery of Illinois chambers of commerce, many of which were hard-hit by the pandemic but continued to provide vital support to local businesses. With $5 million in funding, it will help chambers recover from revenue losses and continue their essential work. Through a grant program established by the Illinois Department of Commerce and Economic Opportunity, eligible chambers can receive up to one-sixth of their 2019–2020 revenue loss. If any funds remain after these initial grants, additional awards will be given to qualifying chambers. The law applies to chambers with annual revenues up to $1 million, marking a major victory for small businesses. Thank you to the chambers and legislators who championed this initiative, this is a significant win for the small business community! Learn more  The Illinois General Assembly has enacted a new law to support small businesses, create opportunities for formerly incarcerated individuals, enhance public safety, and lower recidivism costs. The law increases the tax credit for businesses hiring formerly incarcerated individuals from 5% to 15% of qualified wages and raises the incentive cap from $1,500 to $7,500. By facilitating stable employment for these individuals, the risk of recidivism drops by 62%, thereby improving public safety. This initiative not only aids the Illinois economy by reducing reincarceration costs but also generates long-term revenue through taxes paid by these employees. The General Assembly has allocated $1,000,000 to this program, encouraging small businesses to take advantage of this opportunity. Learn more

The Illinois General Assembly has enacted a new law to support small businesses, create opportunities for formerly incarcerated individuals, enhance public safety, and lower recidivism costs. The law increases the tax credit for businesses hiring formerly incarcerated individuals from 5% to 15% of qualified wages and raises the incentive cap from $1,500 to $7,500. By facilitating stable employment for these individuals, the risk of recidivism drops by 62%, thereby improving public safety. This initiative not only aids the Illinois economy by reducing reincarceration costs but also generates long-term revenue through taxes paid by these employees. The General Assembly has allocated $1,000,000 to this program, encouraging small businesses to take advantage of this opportunity. Learn more  Each year Illinois awards government contracts to businesses. These contracts cover everything from construction projects to professional services. Small businesses that drive our economy often have difficulty competing for these government contracts. The same is true for minority and women-owned businesses. Recognizing the important role that small, minority, and women-owned businesses play in the economy, the Illinois legislature has set goals for state agencies. This legislation will require each state agency to provide important information about how much money they spent on government contracts and the amounts awarded to small, minority, and women-owned businesses. As well as require this information be made public so that Illinoisans can see how their tax dollars are being spent. A state contact can help a small, minority, and women-owned business grow and flourish. This legislation will provide transparency and that will ensure eligible and qualified small, minority, and women-owned businesses receive government contracts. Learn more

Each year Illinois awards government contracts to businesses. These contracts cover everything from construction projects to professional services. Small businesses that drive our economy often have difficulty competing for these government contracts. The same is true for minority and women-owned businesses. Recognizing the important role that small, minority, and women-owned businesses play in the economy, the Illinois legislature has set goals for state agencies. This legislation will require each state agency to provide important information about how much money they spent on government contracts and the amounts awarded to small, minority, and women-owned businesses. As well as require this information be made public so that Illinoisans can see how their tax dollars are being spent. A state contact can help a small, minority, and women-owned business grow and flourish. This legislation will provide transparency and that will ensure eligible and qualified small, minority, and women-owned businesses receive government contracts. Learn more  View the press release

View the press release  Chicago’s City Council passed an ordinance that reinstates policies that expand outdoor dining in Chicago. This ordinance will permit restaurants and taverns to serve customers near the curb, on the sidewalks of adjacent buildings, and in parking areas in proper situations. The ordinance also permits street closures to support local restaurants and taverns should various conditions be satisfied. Learn more

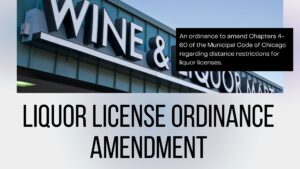

Chicago’s City Council passed an ordinance that reinstates policies that expand outdoor dining in Chicago. This ordinance will permit restaurants and taverns to serve customers near the curb, on the sidewalks of adjacent buildings, and in parking areas in proper situations. The ordinance also permits street closures to support local restaurants and taverns should various conditions be satisfied. Learn more  The Small Business Advocacy Council and various city chambers supported ordinance 02018-7001. The ordinance made conforming changes to the previously enacted state legislation, SB2436, which grants localities the authority to issue exemptions to the 1934 Illinois Liquor Control Law prohibiting restaurants located within a 100 feet of a church, school, hospital and certain other building from serving alcohol to their guests. The ordinance grants authority and sets forth a process for the Local Liquor Control Commissioner to issue a liquor license to the applicant restaurant. While also leaving an outlet for aldermanic objections. The adoption of the ordinance has made it easier for restaurants and bars to make a profit in areas previously prohibited from serving alcohol.

The Small Business Advocacy Council and various city chambers supported ordinance 02018-7001. The ordinance made conforming changes to the previously enacted state legislation, SB2436, which grants localities the authority to issue exemptions to the 1934 Illinois Liquor Control Law prohibiting restaurants located within a 100 feet of a church, school, hospital and certain other building from serving alcohol to their guests. The ordinance grants authority and sets forth a process for the Local Liquor Control Commissioner to issue a liquor license to the applicant restaurant. While also leaving an outlet for aldermanic objections. The adoption of the ordinance has made it easier for restaurants and bars to make a profit in areas previously prohibited from serving alcohol.