Current SBAC Blog:

Proposed Chicago Ordinances That Will Impact Small Businesses

June 24, 2025

Chicago’s small and local businesses drive the city’s economy, foster economic development, create jobs, and support local communities. This blog highlights two proposed ordinances that will impact the small business community.

There is a recently filed ordinance that will require all licensed businesses to maintain functioning surveillance cameras positioned to record all entrance and egress doorways used by the general public and all parking areas of the licensed premises accessible to the public. We understand these cameras can improve public safety, but are concerned about the costs of installing and maintaining these cameras for small businesses. The SBAC will be engaging with alderpersons and stakeholders in an effort to strike the right balance between improving public safety and ensuring local businesses are not hurt by increased costs. You can find the Proposed Camera Ordinance Here.

Another pending ordinance will impact how businesses can display window signs. Once again, we believe policymakers can strike the right balance between improving public safety, maintaining the integrity of local communities, and ensuring small businesses are not impacted by unintended consequences. You can find the Proposed Sign Ordinance Here.

Please reach out to us for more information about these ordinances and if they will impact you, and how to get involved. You can reach us at info@sbacil.org.

Advocacy Blogs

Proposed Chicago Ordinances That Will Impact Small Businesses

June 24, 2025

Chicago’s small and local businesses drive the city’s economy, foster economic development, create jobs, and support local communities. This blog highlights two proposed ordinances that will impact the small business community.

There is a recently filed ordinance that will require all licensed businesses to maintain functioning surveillance cameras positioned to record all entrance and egress doorways used by the general public and all parking areas of the licensed premises accessible to the public. We understand these cameras can improve public safety, but are concerned about the costs of installing and maintaining these cameras for small businesses. The SBAC will be engaging with alderpersons and stakeholders in an effort to strike the right balance between improving public safety and ensuring local businesses are not hurt by increased costs. You can find the Proposed Camera Ordinance Here.

Another pending ordinance will impact how businesses can display window signs. Once again, we believe policymakers can strike the right balance between improving public safety, maintaining the integrity of local communities, and ensuring small businesses are not impacted by unintended consequences. You can find the Proposed Sign Ordinance Here.

Please reach out to us for more information about these ordinances and if they will impact you, and how to get involved. You can reach us at info@sbacil.org.

City Council Passes Ordinance Supporting Chicago Outdoor Dining and Reducing Red Tape

Chicagoans love to eat outdoors, and the Chicago City Council just passed an ordinance that will support the restaurants that make it happen. The Chicago City Council has passed an ordinance that will offer two-year sidewalk café permits to reduce red tape for restaurants. It will also allow establishments to have 2 rather than 1 pool table and 4 arcade machines instead of 3 without needing a Public Place of Amusement License. Alderman Matthew J. Martin championed this ordinance, which is strongly supported by the Small Business Advocacy Council. You can see the full ordinance here: Sidewalk Cafe Ordinance

This ordinance will go into effect on December 1, 2025. These types of reforms are exactly what is needed to support local businesses and communities!

The small business community scored a big win when the Small Business Job Creation Tax Credit Act advanced out of the House Revenue and Finance Committee. This legislation will support small businesses by establishing $2500.00 tax credits for businesses with 50 or fewer employees that hire a net new employee. These tax credits will help businesses grow, create jobs, and support local communities. The process for procuring these tax credits will not be complex, so small businesses will not have to expend considerable time and money to navigate the process.

The tax credits created through the Small Business Job Creation Tax Credit program will create 20,000 new jobs over five years, foster economic development, and generate revenue for the state. Reinstating this program will be a big win for the small business community.

The next step is for this legislation to pass the Illinois House and move to the Senate. We would like to thank Assistant Majority Leader Curtis Tarver for being the Chief Sponsor of this bill and Representative Barbara Hernandez, Representative Kevin John Olickal and Representative Martin McLaughin for co-sponsoring this legislation.

Read the Fact sheet HERE

Why is the small business community well-positioned to push through the noise? Because small business owners know how to communicate, negotiate, compromise, and solve problems.

Small business owners understand that listening to many points of view is often necessary to achieve their objectives, even when everyone does not agree.

READ THE WHOLE ARTICLE HERE: The Small Business Community Can Bring People Together

Each year, we hope politicians will prioritize and enact policies that support the small business community. Over the past few years, we have scored victories by partnering with legislators who care about small businesses' success. However, this year much more must be done to create a better climate for small and local businesses.

We strongly encourage Illinois politicians to include these among their New Year’s resolutions.

READ THE WHOLE ARTICLE HERE: Politicians should embrace these New Year’s resolutions

There are 132 occupational licenses in Illinois. Let’s reflect on that for a moment and consider whether there are ways to protect the safety, welfare, and health of the public without needlessly hurting entrepreneurs and small businesses. The red tape associated with monitoring and enforcing all these licenses also costs the state money. It is time we take a pause to re-assess.

The Small Business Advocacy Council and IJ Clinic on Entrepreneurship are working together to pass legislation that will put a one-year pause on new occupational licenses. The bill also provides that more information will be made available for legislators before they decide on changing and enacting occupational licenses.

We look forward to working with bill sponsors Representative Michael Crawford and Senator Willie Preston on getting this legislation passed in 2025. We can protect the public without unnecessarily burdening entrepreneurs and stifling the workforce!

SBAC ACTION CALL: Contact Your Legislators on Economic Incentives

Please consider reaching out to your legislators and asking them to sponsor the Small Business Job Creation Tax Credit Act and Small Business Property Tax Relief Act. Below are current sponsors of this legislation, so if you reach out to them, it can be to thank them. We have also included the link to find your legislators below and the individual fact sheets for this legislation.

A telephone call to your legislators’ offices or an email letting them know you support this legislation and asking them to sponsor these bills (unless they are already sponsors) will be extremely helpful.

Please note: Sponsors may be added as the session continues. We will update as needed, but you may check sponsors quickly by clicking on the bill number link below.

NAME

Small Business Job Creation Tax Credit

House Sponsors

Rep. Curtis Tarver

Rep. Barbara Hernandez

Rep. Kevin Olickal

Rep. Martin McLaughlin

Senate Sponsors

Sen. Willie Preston

Sen. Adriane Johnson

Sen. Mattie Hunter

Sen. Laura Fine

Sen. Bill Cunningham

Small Business Property Tax Relief Act

Rep. Debbie Meyers-Martin

Rep. Lindsey LaPointe

Rep. Kevin Olickal

Sen. Bill Cunningham

Sen. Javier Cervantes

Sen. Adriane Johnson

Sen. Cristina Castro

Sen. Willie Preston

Sen. Julie Morrison

Sen. Seth Lewis

Sen. Laura Fine

Sen. Mattie Hunter

Here is the link to find your legislators: https://bit.ly/CTCLegislatorIL. You can scroll to the bottom of the page to find your state legislators.

Here are the fact sheets for the bills:

Let’s come together to support the small business community!

Shop Small, Shop Local: Support Chicago’s Neighborhood Businesses This Holiday Season

As the holiday season approaches, it’s time to consider the impact of where we shop. Supporting small, local businesses not only helps fuel Chicago’s economy but also strengthens our communities.

This year, make a commitment to shop small and explore the diverse businesses across our city. Whether you're searching for a unique gift, delicious holiday treats, or one-of-a-kind experiences, local shops offer something for everyone on your list.

To make holiday shopping even easier, check out Block Club Chicago’s Ultimate Guide To Shopping Local In Chicago For The Holidays 2024. This comprehensive guide allows you to shop by neighborhood, showcasing hundreds of gift ideas from local businesses across the city.

Let’s make this holiday season one of community, connection, and support for the small business owners who make Chicago vibrant!

Endorsed By:

Alderman Anthony Beale

Alderman Felix Cardona

Alderman Peter Chico

Alderwoman Angela Clay

Alderwoman Ruth Cruz

Alderman Derrick Curtis

Alderwoman Jessie Fuentes

Alderman James Gardiner

Alderwoman Maria Hadden

Alderman William Hall

Alderwoman Michelle Harris

Alderman Brian Hopkins

Alderwoman Leni Manaa-Hoppenworth

Alderman Tim Knudsen

Alderman Dan LaSpata

Alderman Bennett Lawson

Alderman Matt Martin

Alderwoman Emma Mitts

Alderman David Moore

Alderman Anthony Napolitano

Alderwoman Julia Ramirez

Alderman Carlos Ramirez-Rosa

Alderman Lamont Robinson

Alderman Mike Rodriguez

Alderman Byron Sigcho-Lopez

Alderman Nicholas Sposato

Alderwoman Silvana Tabares

Alderwoman Jeanette Taylor

Alderman Gilbert Villegas

Alderman Andre Vasquez

Alderman Scott Waguespack

Alderman Desmond Yancy

SBAC on the Move: Advocating for the Small Business Community

At the SBAC, we’re committed to ensuring that small businesses have a seat at the table regarding policymaking. Over the last few months, the SBAC has heavily engaged with policymakers and community leaders to advocate for small businesses. From forums to roundtables, we’ve connected with key decision-makers throughout Illinois. Our calendar of events is a great one-stop SBAC event page to stay connected and check out upcoming legislative events to attend.

Here’s a roundup of a few recent events:

Greater Wheeling Chamber Legislative Forum

The SBAC and the Greater Wheeling Area Chamber of Commerce hosted a community-driven legislative forum featuring key legislators. Among those present were Congressman Brad Schneider, State Senator Adriane Johnson, and State Representatives Mary Beth Canty, Daniel Didech, and Tracy Katz Muhl. Attendees could engage directly with lawmakers, ask questions, and share concerns on issues affecting their community and businesses.

Hospitality Industry Roundtable

Our team recently participated in the Illinois Restaurant Association's monthly roundtable to discuss small business trends in the restaurant business. State Representative Tracy Katz Muhl and Julie Morrison, along with employment attorney Robert Bernstein, were among the panelists opening up a discussion about key initiatives the SBAC is pursuing at both the city and state levels. Read more about the SBAC initiatives HERE.

Skokie Legislative Forum

The Skokie Chamber of Commerce invited the SBAC to moderate their annual event. SBAC President Elliot Richardson invoked a lively discussion between Illinois legislators and local business owners. Participants could ask questions and engage in meaningful dialogue about the future of small business advocacy in Illinois with Congresswoman Jan Schakowsky, Senator Villivallam, Senator Fine, Senator Jennifer Gong-Gershowitz, Skokie Chamber Executive Director Howard Meyer, Representative Kevin Olickal, Cook County Commissioner Josina Morita, and Senior Advisor to State Treasurer Frerichs, Marty McCormack.

Neighborhood Revitalization Coalition (NRC) Meeting

The Small Business Advocacy Council, alongside a dedicated coalition of stakeholders, has united with a common goal: to revitalize, empower, and connect commercial corridors within Cook County, ushering our community into a thriving economic future. This collaborative initiative is driven by grassroots engagement, impactful policy advocacy, and educational initiatives. The Neighborhood Revitalization Coalition (NRC) is crucial in advancing policies that benefit small businesses across the city. To learn more about the NRC or get involved, click HERE (NRC).

Prescription Drug Affordability Board Town (PDAB) Hall

The SBAC joined policymakers and advocates at a town hall discussing legislation aimed at reducing the excessive cost of prescription drugs. High insurance premiums remain a barrier for small businesses trying to provide quality health coverage for their employees. The town hall shed light on proposed legislation that would offer much-needed relief. Representatives Nabeela Syed, Terra Costa-Howard and Senator Mary Edly-Allan were present to field questions and respond to concerns. Learn more about our work on PDAB here!

Small Business Roundtable with Senator Preston

Senator Preston invited the SBAC to participate in a community roundtable alongside Greater Englewood Chamber Executive Felicia Slaton-Young, Greater Auburn-Gresham Development Corporation Director Carlos Nelson, and other leaders to discuss strategies, specifically the 2025 agenda and how to assist and strengthen small businesses in the 16th Senate District.

Midway Chamber Membership Meeting

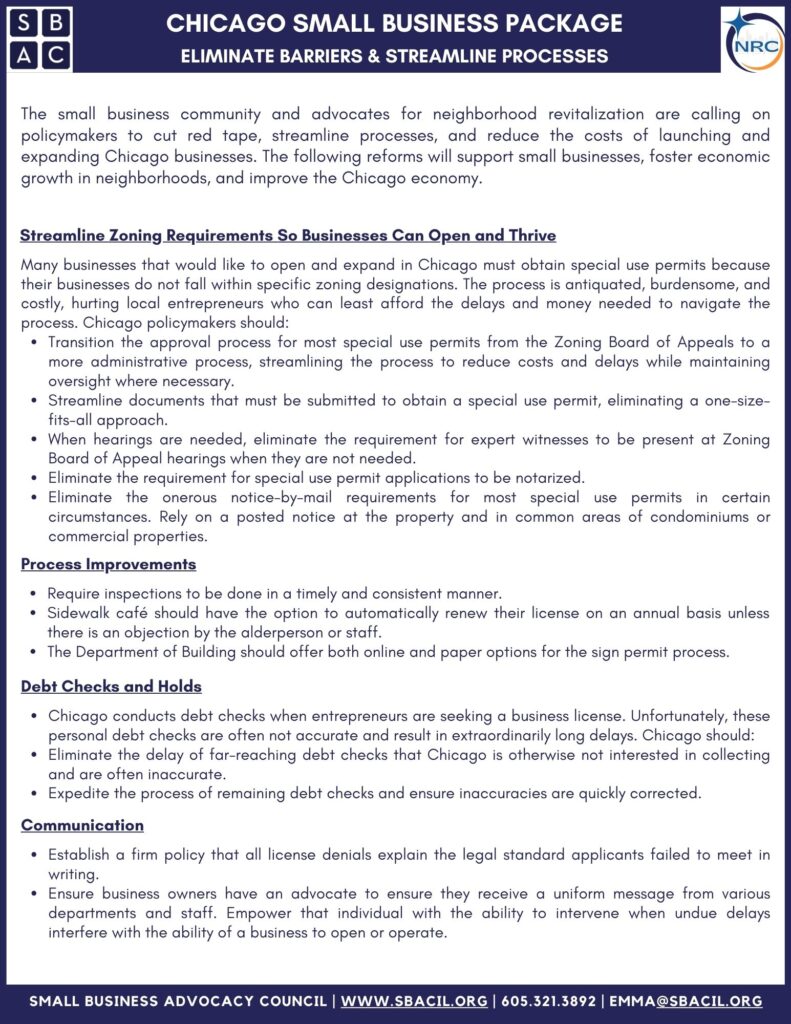

The SBAC was pleased to join the Midway Chamber of Commerce Membership Meeting to discuss the Chicago Small Business Package and other initiatives focused on eliminating barriers and creating new opportunities for small businesses in Chicago. Read more about the Chicago Small Business Package here.

UBC / SBAC Lunch & Learn

Tax Credits & Financial Opportunities for Small Businesses

The SBAC along with Uptown Chamber hosted an informative lunch discussion reviewing possible tax credits and other financial opportunities/incentives for small businesses. This event, moderated by the SBAC's Elliot Richardson, highlighted programs such as the tax credit for hiring formerly incarcerated individuals and ways to access capital. To learn more on possible opportunities, visit the SBAC's Grant and Incentives page.

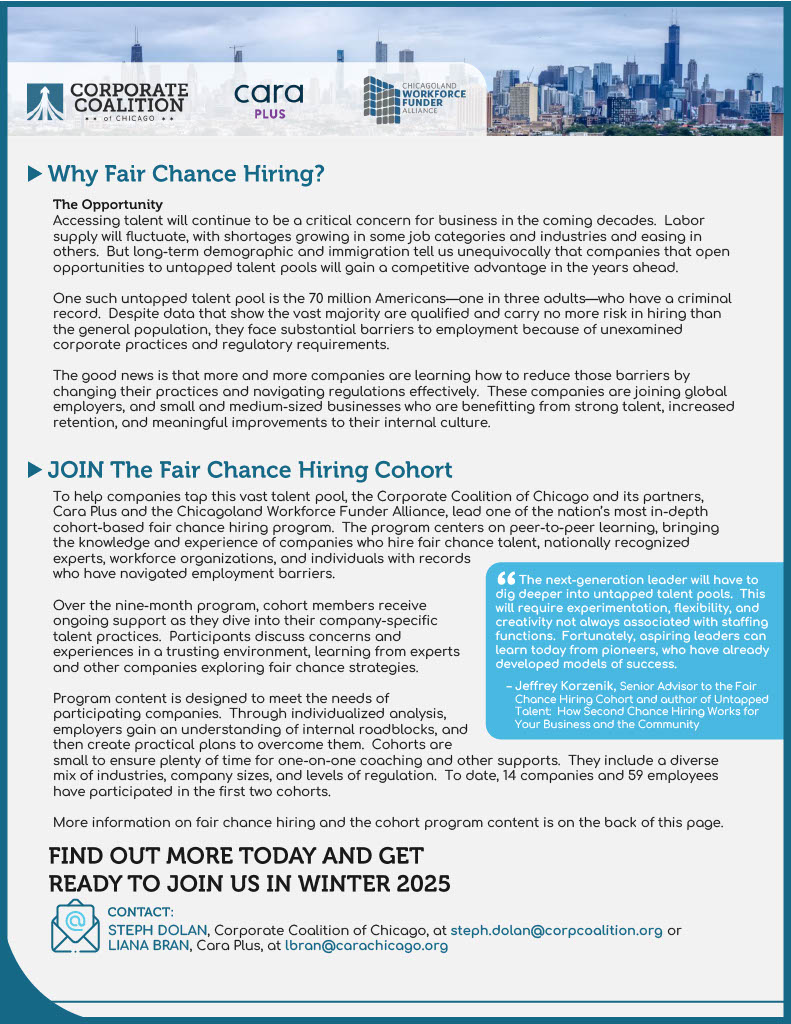

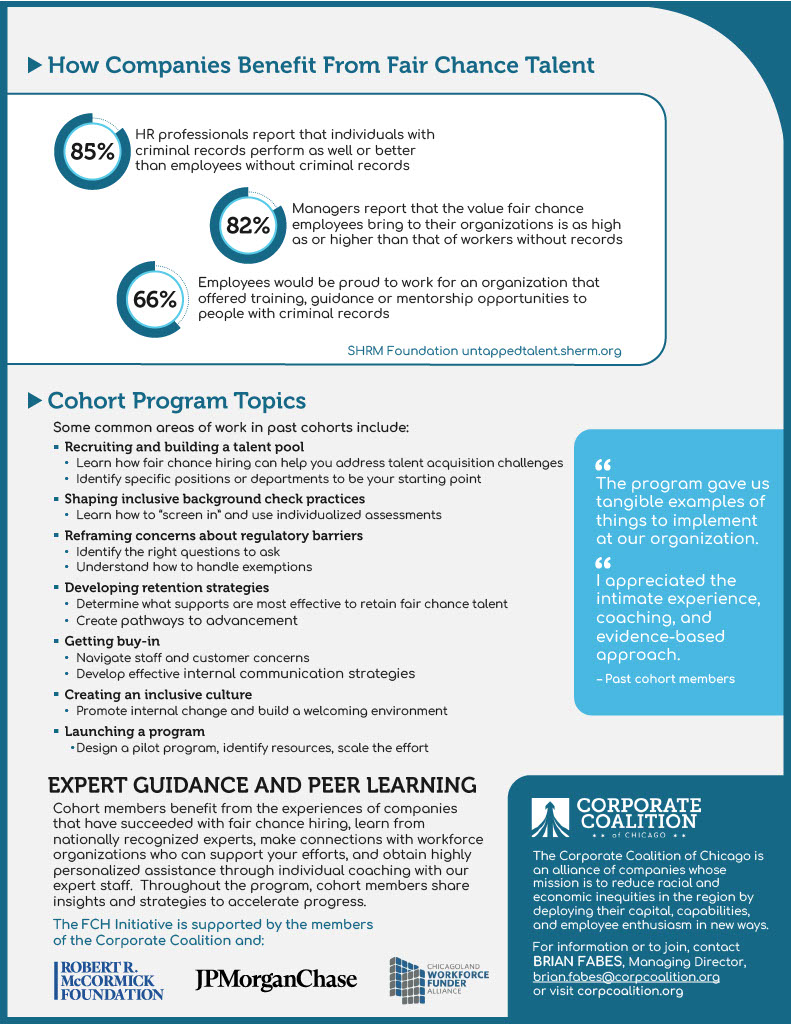

Calling all employers: Third Fair Chance Hiring Cohort launching in Winter 2025!

Join the Fair Chance movement and a growing network of business leaders that recognize the benefit of hiring justice-impacted individuals.

What we do: We work with companies to hire, retain, and advance justice-impacted talent (who represent 1 in 3 working-age Americans). We get to know each company's current policies, share best practices, and provide hands-on support to help your organization decide where and how to take action to pursue fair chance hiring.

Why us? Our nine-month programming brings together business leaders, for best practices, customized coaching, and peer learning to support companies on their fair chance journey. We cover topics ranging from revisiting your background check process to recruiting strategies and partnerships, to launching and scaling fair chance hiring pilots - and more.

Who should join? If your company wants to pursue fair chance hiring and is looking for support to bring this goal to life, this cohort is for you! We ask that employers come ready and eager to (1) share their goals, successes, and challenges with each other and (2) actively identify and drive HR and organizational changes to hire this talent pool.

Want to learn more? Reach out to Steph Dolan (steph.dolan@corpcoalition.org) and Liana Bran (lbran@carachicago.org) to hear why businesses are pursuing fair chance talent and learn more about our program, opportunities to take action, and results from our previous cohorts. You can also learn more here.

SBAC Insights Search

Insights Archive

For media and PR inquiries, please contact River Strategies.

Email: Tslutzkin@riverstrategies.com