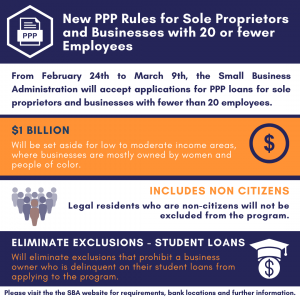

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees. The move is meant to make it easier for businesses with few or no employees – sole proprietors, independent contractors, and self-employed people such as house cleaners and personal care providers – to apply that previously could not qualify due to business cost deductions.

- $1 Billion will be set aside for low to moderate income areas, where businesses are mostly owned by women and people of color.

- Legal residents who are non citizens will not be excluded from the program.

- Will eliminate exclusions that prohibit a business owner who is delinquent on their student loans from applying to the program.

Please visit the SBA website for requirements, bank locations and further information.

Insights Archive

Insights Archive

Larger Tax Credits for Hiring Formerly Incarcerated Individuals

Like Share Tweet Download PDF here SBAC INSIGHTS PAGE Illinois Policymakers Take Bold Action to Support Businesses and Foster Opportunities for Formerly Incarcerated Individuals Press

Policy Committee Contact Information

Policy Committee Contact Information: Aaron Smith Escapingtheoddspodcast@gmail.com Alona Anspach alona.anspach@ihtwm.com Beth Kregor bkregor@ij.org Cathie Van Wert cathie@doubletakedesign.com Chris Lautenslager chris@get-looped.com Chris Allen callen@wshscpa.com Chuck Scharenberg

SBAC Advocacy Update

Like Share Tweet SBAC INSIGHTS PAGE August 6, 2024 We are excited to share some updates about the work we are doing to support the