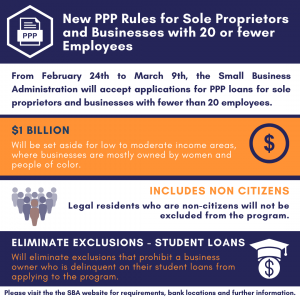

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees. The move is meant to make it easier for businesses with few or no employees – sole proprietors, independent contractors, and self-employed people such as house cleaners and personal care providers – to apply that previously could not qualify due to business cost deductions.

- $1 Billion will be set aside for low to moderate income areas, where businesses are mostly owned by women and people of color.

- Legal residents who are non citizens will not be excluded from the program.

- Will eliminate exclusions that prohibit a business owner who is delinquent on their student loans from applying to the program.

Please visit the SBA website for requirements, bank locations and further information.

Insights Archive

Insights Archive

SBAC Women in Business: Roundtable on Small Businesses and Child Care

The SBAC Women in Business hosted a virtual roundtable with Chairman Edgar Gonzalez Jr. to discuss accessibility to affordable child care and small businesses. It

Mayoral Forum

Small Business Mayoral Forum Like Share Tweet Insights Archive

Legislation to Support Local Chambers Passes

Like Share Tweet Many chambers of commerce were devastated by the pandemic. However, this did not stop them from providing crucial support to local businesses.