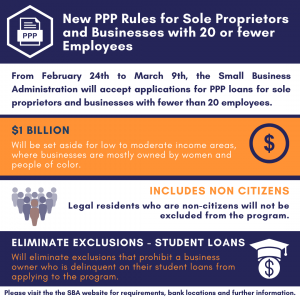

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees. The move is meant to make it easier for businesses with few or no employees – sole proprietors, independent contractors, and self-employed people such as house cleaners and personal care providers – to apply that previously could not qualify due to business cost deductions.

- $1 Billion will be set aside for low to moderate income areas, where businesses are mostly owned by women and people of color.

- Legal residents who are non citizens will not be excluded from the program.

- Will eliminate exclusions that prohibit a business owner who is delinquent on their student loans from applying to the program.

Please visit the SBA website for requirements, bank locations and further information.

Insights Archive

Insights Archive

Hear From our NRC Coalition Partners

Home NRC Policy Agenda NRC Calender NRC Videos NRC Blog The Small Business Advocacy Council and a coalition of engaged stakeholders have come together to

The SBAC Heads to Springfield to Fight for the Small Business Community

Like Share Tweet The SBAC Heads to Springfield to Fight for the Small Business Community The Small Business Advocacy Council (SBAC) is heading to the

SBAC 2022 Legislative Agenda

Like Share Tweet SBAC 2022 Legislative Agenda The Small Business Advocacy Council (SBAC) is laser-focused on formulating and fighting to pass policies that support small