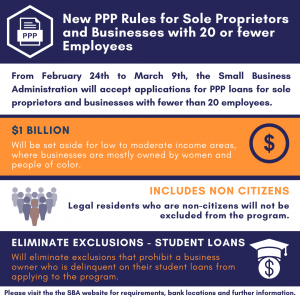

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees.

The move is meant to make it easier for businesses with few or no employees - sole proprietors, independent contractors, and self-employed people such as house cleaners and personal care providers - to apply that previously could not qualify due to business cost deductions.

In addition to the 2-week application period:

- $1 Billion will be set aside for low to moderate income areas, where businesses are mostly owned by women and people of color.

- Legal residents who are non citizens will not be excluded from the program.

- Will eliminate exclusions that prohibit a business owner who is delinquent on their student loans from applying to the program.

Please visit the SBA website for requirements, bank locations and further information.

Proposed Chicago Ordinances That Will Impact Small Businesses (Camera & Sign)

Proposed Chicago Ordinances That Will Impact Small Businesses June 24, 2025 Chicago’s small and local businesses drive the city’s economy, foster economic development, create jobs, and support local communities. This blog highlights two proposed ordinances that will impact the small business community. There is a recently filed ordinance that will require all licensed businesses…

Proposed Ordinance Supports Outdoor Dining

City Council Passes Ordinance Supporting Chicago Outdoor Dining and Reducing Red Tape Chicagoans love to eat outdoors, and the Chicago City Council just passed an ordinance that will support the restaurants that make it happen. The Chicago City Council has passed an ordinance that will offer two-year sidewalk café permits to reduce red tape for…

Job Creation Tax Credit Bill That Supports Small Businesses Moves Out of Committee

Bill That Supports Small Businesses Moves Out of Committee The small business community scored a big win when the Small Business Job Creation Tax Credit Act advanced out of the House Revenue and Finance Committee. This legislation will support small businesses by establishing $2500.00 tax credits for businesses with 50 or fewer employees that hire…