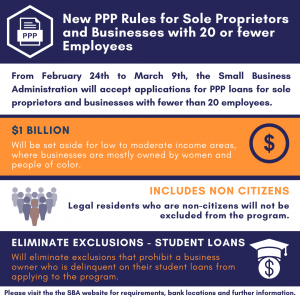

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees.

The move is meant to make it easier for businesses with few or no employees - sole proprietors, independent contractors, and self-employed people such as house cleaners and personal care providers - to apply that previously could not qualify due to business cost deductions.

In addition to the 2-week application period:

- $1 Billion will be set aside for low to moderate income areas, where businesses are mostly owned by women and people of color.

- Legal residents who are non citizens will not be excluded from the program.

- Will eliminate exclusions that prohibit a business owner who is delinquent on their student loans from applying to the program.

Please visit the SBA website for requirements, bank locations and further information.

Byline Bank – Insights

Byline Bank’s Insights We all need more “Insight” into what makes a business successful and how to get there. We are proud to highlight our partner, Byline Bank, and their professional insight into achieving financial success. Follow this link to view all of Byline Bank’s Insights or view snippets of the three most relevant and…

PNC Bank – Insights

Insights from PNC Bank We all need more “Insight” into what makes a business successful and how to get there. We are proud to highlight our partner, PNC Bank, and their professional insight into achieving financial success. Follow this link to view all of PNC Bank’s Insights or view snippets of the three most relevant…

DHBL Elliot Monthly Insights

SBAC INSIGHTS PAGE February 2025 The Small Business Community Can Bring People Together Why is the small business community well-positioned to push through the noise? Because small business owners know how to communicate, negotiate, compromise, and solve problems. Small business owners understand that listening to many points of view is often necessary to achieve their…