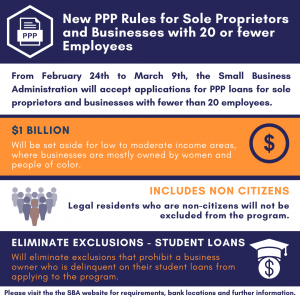

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees.

The move is meant to make it easier for businesses with few or no employees - sole proprietors, independent contractors, and self-employed people such as house cleaners and personal care providers - to apply that previously could not qualify due to business cost deductions.

In addition to the 2-week application period:

- $1 Billion will be set aside for low to moderate income areas, where businesses are mostly owned by women and people of color.

- Legal residents who are non citizens will not be excluded from the program.

- Will eliminate exclusions that prohibit a business owner who is delinquent on their student loans from applying to the program.

Please visit the SBA website for requirements, bank locations and further information.

Support Small Business and Prevent Foreclosures

The COVID-19 pandemic continues to have a devastating impact on the small business community. Many small businesses are struggling to pay their employees and rent. Commercial property owners cannot pay their mortgage when their small business tenants cannot pay rent. Without swift action, small businesses will fail and foreclosures will skyrocket. Federal Legislation Needed The…

SBAC’s Elliot Richardson on WGN Radio

SBAC’s Elliot Richardson talks with Anna Davlantes on WGN Radio about the impact the pandemic has had on the small business community. There has never been a more important time to stand with small business than right now! Listen to the whole 8-minute interview here: Listen to the Interview Here

Restart Act

THE RESTART ACT The RESTART Act provides a new loan program to fund six (6) months of payroll and fixed operating expenses. Some, or the entirety of the loan, is eligible for forgiveness. The amount that is not forgiven is to be repaid over seven years with favorable interest rates. The loan is 100% guaranteed…