Occupational licenses should protect the health, safety and welfare of the public. Unfortunately, some occupational licenses are unnecessary and burdensome. They create unwarranted barriers for Illinois entrepreneurs and those interested in working in new professions.

Needless occupational licenses also keep people from moving to Illinois. Needless occupational licenses, or those which are overly restrictive, also hurt small businesses struggling to find qualified employees.

Illinois policymakers can support small businesses, create jobs and empower entrepreneurs by guarding against the imposition of unnecessary red tape through new occupational licenses. Legislation has already been filed which, if passed, will establish a process to investigate and review whether new occupational and professional licenses are necessary.

Illinois House Bill 4012 will permit any individual or interested party to ask the Department of Financial and Professional Regulation to review proposed legislation establishing new licenses or expanding the scope of those already in existence. The department will then be empowered to make recommendations to legislators before they vote to establish another occupational license.

Illinois legislators should also eliminate or modify unnecessary and burdensome licenses already on the books in Illinois. For example, a barber in Illinois must complete 1,500 hours of education, which is often costly, before being able to cut hair or start their own business.

This is only one example of a license that creates barriers for people trying to work.

Read the article in its entirety here

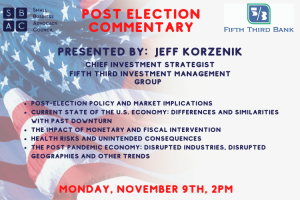

SBAC and Fifth Third Bank Present: Post Election Commentary by Jeff Korzenik

A Post Election Commentary Presented by: Jeff Korzenik Managing Director, Chief Investment Strategist, Fifth Third Investment Management Group Discussion Points: Post-Election Policy and Market Implications Current State of the U.S. Economy: Differences and Similarities with Past Downturns The Impact of Monetary and Fiscal Intervention Health Risks and Unintended Consequences The Post Pandemic Economy: Disrupted Industries, Disrupted…

Graduated Income Tax Town Hall Recording 9/24/2020

The resounding success of our last Graduated Income Tax Town Hall has prompted the IACCE and SBAC to partner on a follow-up forum. Ralph Martire and Leslie Munger returned to answer your questions about the proposed graduated income tax. Ralph Martire is the Executive Director for the Center for Tax and Budget Accountability and Rubloff Professor…

R.I.S.E. Act

READ HB-0801 HERE READ SB-2490 HERE TAKE ACTION Recovery Initiative to Support Employment Small businesses in many industries are struggling and as a result, have no choice but to layoff valued employees. Entrepreneurs and independent contractors in the fields most impacted by the pandemic are also losing their businesses. The COVID-19 pandemic has been unforgiving…