Baking Good Legislation

On August 27, Governor Pritzker signed into law the Home-to-Market Act. The Home-to-Market Act allows producers of home-based food products to sell their goods directly to customers. This new law goes into effect on January 1, 2022. This will foster the growth of home-based entrepreneurs, known as the cottage food businesses.

Prior to the passage of the Home-to-Market Act, cottage food producers were only allowed to sell their products at farmer's markets. They were prohibited from selling at fairs or festivals, and online. Compared to other states, Illinois has one of the most restrictive regulations governing the cottage food industry. This new act will open the door for a vast increase in sales and provide cottage producers the opportunity to start or grow their businesses. The Home-to-Market Act comes at the perfect time as many of these home-based food businesses and farms were hit hard by the pandemic. During the pandemic, many farmer's markets delayed their openings, leaving cottage food producers unable to sell their products. The new bill will especially benefit women-owned businesses, as 77% of cottage food businesses are owned by women.

The SBAC is a strong advocate for home-based businesses. Check out our most recent win regarding HBBs.

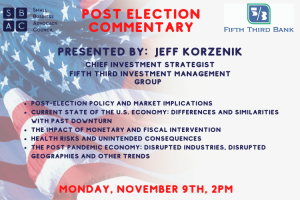

SBAC and Fifth Third Bank Present: Post Election Commentary by Jeff Korzenik

A Post Election Commentary Presented by: Jeff Korzenik Managing Director, Chief Investment Strategist, Fifth Third Investment Management Group Discussion Points: Post-Election Policy and Market Implications Current State of the U.S. Economy: Differences and Similarities with Past Downturns The Impact of Monetary and Fiscal Intervention Health Risks and Unintended Consequences The Post Pandemic Economy: Disrupted Industries, Disrupted…

Graduated Income Tax Town Hall Recording 9/24/2020

The resounding success of our last Graduated Income Tax Town Hall has prompted the IACCE and SBAC to partner on a follow-up forum. Ralph Martire and Leslie Munger returned to answer your questions about the proposed graduated income tax. Ralph Martire is the Executive Director for the Center for Tax and Budget Accountability and Rubloff Professor…

R.I.S.E. Act

READ HB-0801 HERE READ SB-2490 HERE TAKE ACTION Recovery Initiative to Support Employment Small businesses in many industries are struggling and as a result, have no choice but to layoff valued employees. Entrepreneurs and independent contractors in the fields most impacted by the pandemic are also losing their businesses. The COVID-19 pandemic has been unforgiving…