Pandemic Makes Student Debt Relief Crucial

Over 45 million Americans collectively owe an approximate $1.6 trillion in student loans. This exorbitant debt stifles our economy and impedes the mobility of young Americans who thought going to college would provide financial security.

The economic impact of the pandemic has put Americans further into debt and has had a profound impact on the job market. It is time to tackle the student debt crisis so that young Americans can financially recover from the pandemic.

The Small Business Advocacy Council is advocating for the following reforms:

- Capping Interest Rates at 3.5%: Cap interest rates at 3.5% immediately regardless of lender or program. Some former college students are paying 9% interest rates on their loans. That is not acceptable.

- Refinancing of Loans with Federal Loan Servicers: Allow borrowers to refinance loans with federal loan servicers, thus reducing their interest payments and positively enhancing their debt-to-income ratio.

- Reasonable Student Debt Reduction: Forgive a reasonable portion of American’s student debt given the financial impact of the pandemic.

- Principal and Interest Deferment for Medical Hardship: Allow young professionals who develop serious medical conditions to defer both principal and interest on their student debt. This should apply to those forced to postpone their education because of an illness.

The SBAC is committed to fighting for policies that meaningfully address the student debt and provide millions of Americans the opportunity to get out from underneath crushing debt. This will also stimulate our economy at a crucial time!

What 2021 Could Mean for Small Businesses

January 20, 2021 By Elliot Richardson Small Business Advisory Council SBAC President Elliot Richardson’s column discusses the Business and Economic Outlook Forum hosted by the Daily Herald Business Ledger. The piece highlights the need for legislation that provides financial resources for small businesses to retrain and hire Illinoisans who have lost their jobs or businesses…

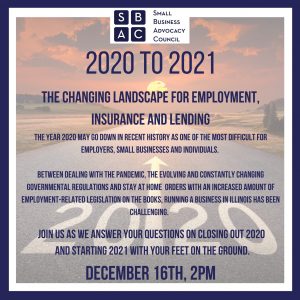

2020 to 2021 The Changing Landscape for Employment, Insurance and Lending

While mental health issues in the workplace have been a concern for some time, this past year, COVID-19 has shown the challenges employees are facing have spiked dramatically. Hear from Jason Tremblay on how this will impact both employers and their employees in the video. Stephen Ball from Fifth Third discusses automatic forgiveness for PPP…

Univision entrevista a Neli Vasquez-Rowland

Muchas gracias a univision para su reportaje sobre nuestra campaña conjunta con a Safe Haven Foundation para mantener a las pequenas empresas aflote y para prestar asistencia a las personas mas necesitadas durante este periodo tan dificil.